Rental Property Capital Gains Tax Worksheet

Using the capital gain or loss worksheet Overview. There are two versions of this worksheet.

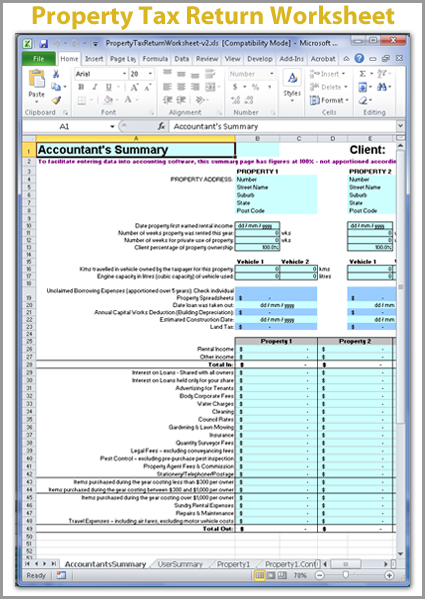

Property Tax Return Worksheet Ban Tacs

Your capital gain.

Rental property capital gains tax worksheet. Add 38 Affordable Care Act. 72K Taxed at Capital gains rate of 5 or 15 30K Depreciation Generally taxed at 25 rateIn this example an investor pays 11100 if 5 capital gains tax rate or 18300 if 15 capital gains tax rate in taxes on a 102K gain. Personal Income Tax Worksheet - 2021 Personal Income Tax worksheet.

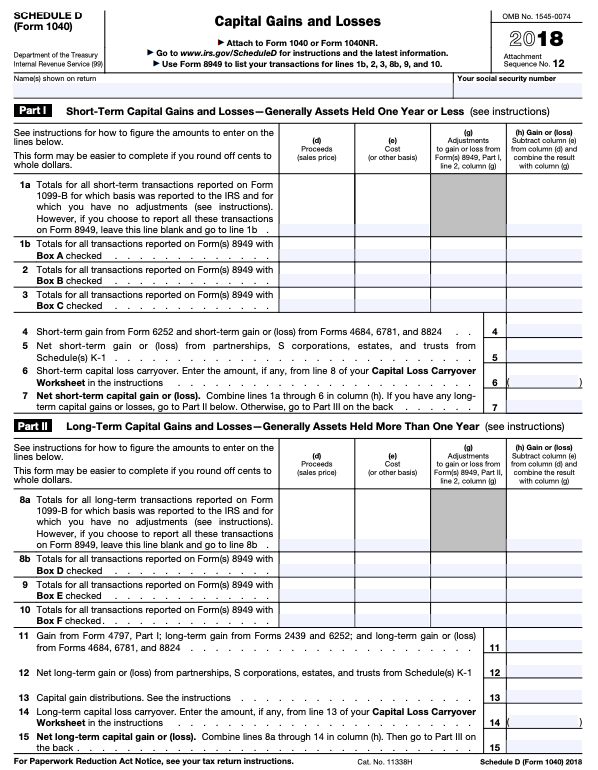

Capital Gains Worksheet - 2021 Capital Gains Tax worksheet. To calculate the capital gain and capital gains tax liability subtract your adjusted basis from the sales price of the property then multiply by the applicable long-term capital gains tax rate. 60000 x 20 tax rate 12000.

A capital gain or loss is the difference between what it cost you to obtain and improve the property the cost base and the amount you receive when you dispose of it. You show the type of CGT asset or CGT event that resulted in the capital gain or capital loss and. General value shifting regime.

How long you own a rental property and your taxable income will determine your capital gains tax rate. 10 12 22 24 32 35 and 37. Tax rates for short-term gains in 2020 are.

WORKSHEET 33 OTHER TAX CONSIDERATIONS 34 Capital gains tax 34 General value shifting regime 35 Goods and services tax GST 35 Negative gearing 35 Pay as you go PAYG instalments 35 RESIDENTIAL RENTAL PROPERTY ASSETS 36 Definitions 36 Residential rental property items 38 MORE INFORMATION 47 Website 47 Publications 47 Phone 48 Other services 48. The tax rate can vary from 0 to 396 depending on two factors - Your income bracket and whether it is considered as a short or long term capital gains. Once you have sold your rental property you must subtract the adjusted basis from the selling price to determine what gains will be taxed under the capital gains tax rate.

Pay as you go PAYG instalments. List the dispositions of all your rental properties on Schedule 3 Capital Gains or Losses. If you feel like safely and securely submitting this via our website please use this redirect link-.

Finally the amount taxed at capital gains rate of 5 or 15 is calculated by subtracting depreciation from gain. For more information on how to calculate your taxable capital gain see Guide T4037 Capital Gains. Capital gain 134400 sales price - 74910 adjusted basis 59490 gains subject to tax.

If you purchased a new rental property during the year please ensure you include the details in the worksheet for the. Short-term investments held for one year or less are taxed at your ordinary income tax rate. Goods and services tax GST Negative gearing.

And 2 you have not sold or exchanged another home during the two years preceding the. 1 You owned and lived in the home as your principal residence for two out of the last five years. Selling your rental property If you sell a rental property for more than it cost you may have a capital gain.

At this point our capital gains tax liability would be 22000 10000 depreciation recapture 12000 on long-term gain. Capital gains are taxed at the same rate as taxable income ie. Record of Purchases for Capital Gains Tax Purposes.

When you sell your. If you owned the property as your personal residence and then converted it to a rental the basis for depreciation and capital gains is the lower of the fair market value or the adjusted cost basis. The Capital gain or capital loss worksheet PDF 143KB This link will download a file calculates a capital gain or capital loss for each separate capital gains tax CGT event.

Capital Gain lines 6 minus 7 8 Type of Capital Gain - 25 rate gain line 4 above 9 15 rate gain lines 8 minus 9 10 Total Capital Gain lines 9 10 11 Tax Due at Maximum Capital Gains Rate - 25 rate gain x 25 line 9 x 25 12. The application of a capital gain or loss depends on when you acquired the property. If a capital gain was made you calculate it using.

If we are in a 20 long-term capital gains tax bracket our total taxes on this portion of the gain are. If you earn 40000 325 tax bracket per year and make a capital gain of 60000 you will pay income tax for 100000 37 income tax and your capital gains will be taxed at 37. Residential rental property assets.

Motor Vehicle Worksheet - 2021 Motor Vehicle Expence worksheet. A fillable PDF what you are viewing now and an online digital form. Capital Gains Tax Selling Price of Rental Property - Adjusted Cost Basis Capital Gains x Tax Rate Depreciation x 25 Tax Rate.

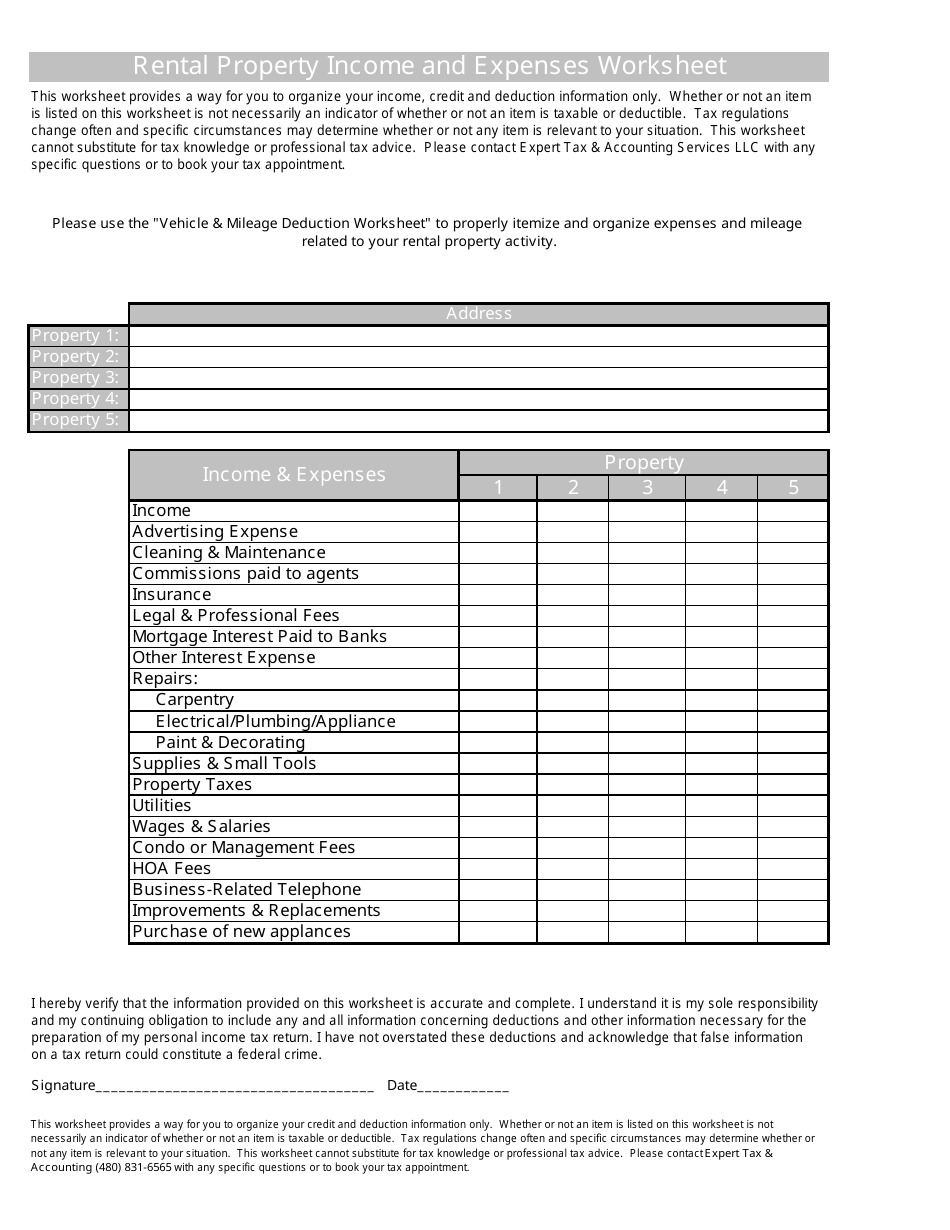

Rental Property Worksheet Please use this worksheet to give us your rental income and expenses for preparation of your tax returns. Rental Property Worksheet - 2021 Rental Property worksheet. A Special Real Estate Exemption for Capital Gains Up to 250000 in capital gains 500000 for a married couple on the home sale is exempt from taxation if you meet the following criteria.

Moving to Australia Foreign Earnings Worksheet - 2021 individuals moving to Australia for. When you sell or dispose of a rental property you may make a capital gain or loss. Adjusted cost basis includes original closing costs improvements and any depreciation already taken.

If you own the asset for longer than 12 months you will pay 50 of the capital gain.

Capital Gains Tax Worksheet Nidecmege

Capital Gains Tax Spreadsheet Shares Capital Gains Tax Capital Gain Spreadsheet Template

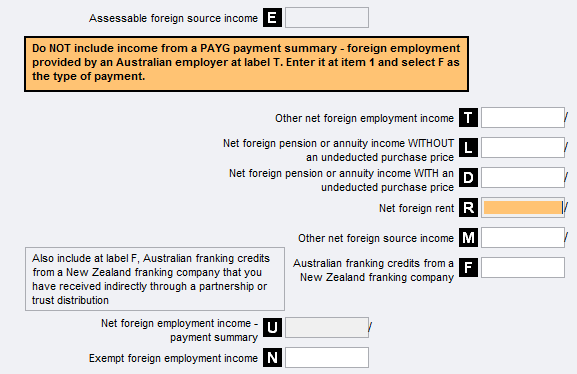

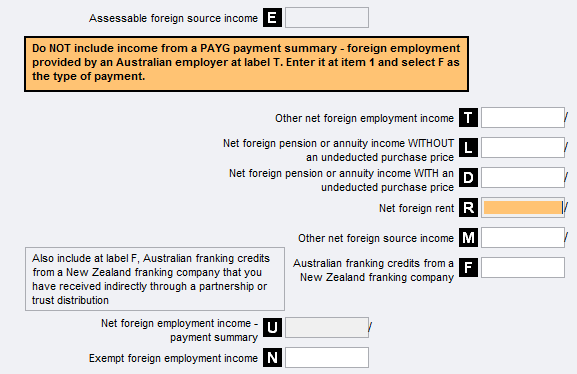

Other Income Category 1 Worksheet Oiy Ps Help Tax Australia 2018 Myob Help Centre

Is Rental Property A Capital Asset And How To Report It Taxhub

It6 Net Rental Income And Deductions Rpl Ps Help Tax Australia 2019 Myob Help Centre

Rental Schedules Ren Rep And Rntlprpty Ps Help Tax Australia 2020 Myob Help Centre

11 Strategies To Minimise Your Capital Gains Tax

Free Negative Gearing Calculator Property Investment

Tax Withheld Lump Sum Payments In Arrears Worksheet Poi Ps Help Tax Australia 2018 Myob Help Centre

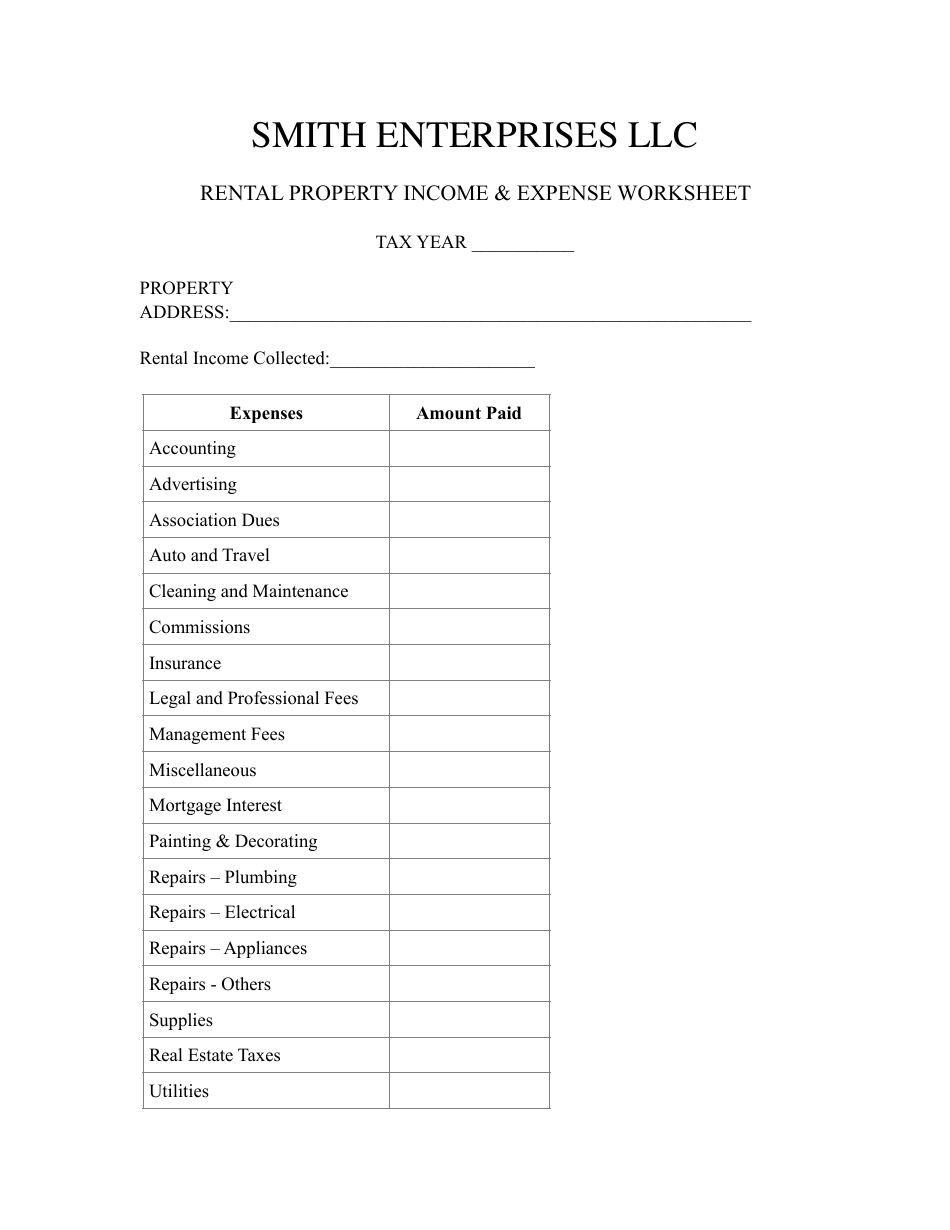

Rental Property Income And Expenses Worksheet Expert Tax Accounting Services Llc Download Printable Pdf Templateroller

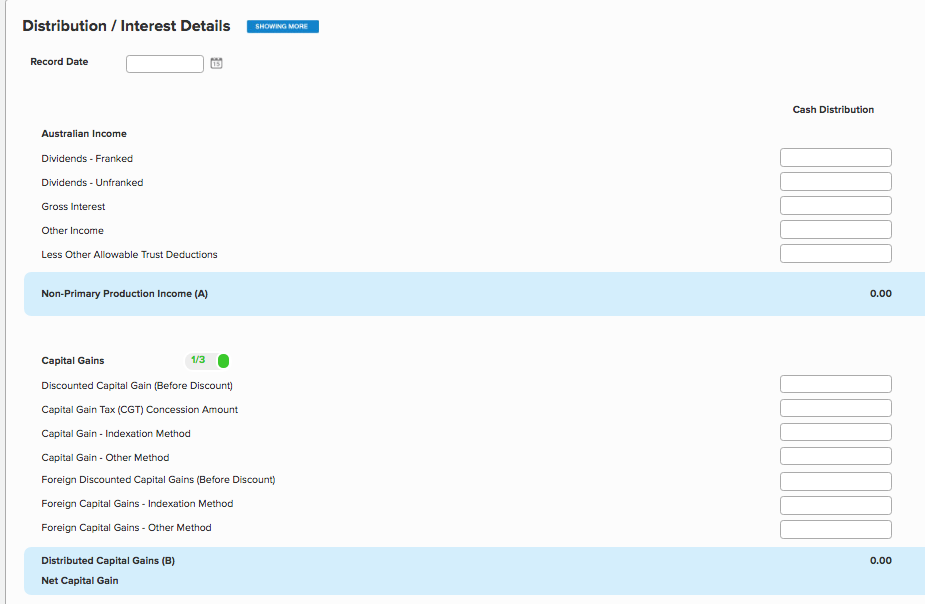

How To Enter A Distribution Tax Statement Simple Fund 360 Knowledge Centre

Foreign Rental Property Worksheet Ref Ps Help Tax Australia 2020 Myob Help Centre

Https Www Ato Gov Au Uploadedfiles Content Mei Downloads 39804n4151glwsht14 Pdf

Capital Gains Tax Calculator Ban Tacs

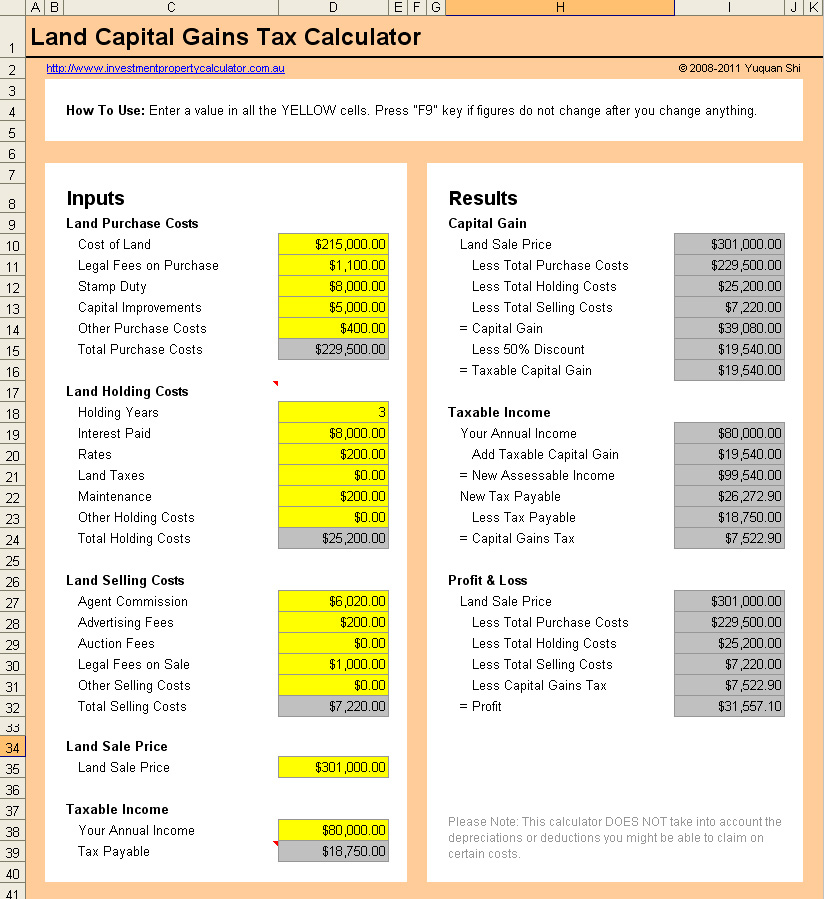

Free Land Capital Gains Tax Calculator

Rental Property Income Expense Worksheet Template Smith Enterprises Download Printable Pdf Templateroller

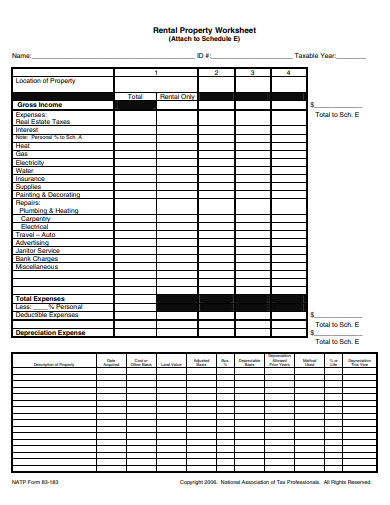

18 Rental Property Worksheet Templates In Pdf Free Premium Templates

.png)

0 comments: